If you are in mortgage trouble in Georgia, Please read this message!

This real estate market has caused unbearable stress and heartache, people unable to keep their homes, children displaced from their school and friends. Today’s distressed homeowners need answers and an advocate to offer options and help them understand their rights. As a realtor, it’s not only my job, it’s my passion to provide the help you need when you need it. Act now to find out what you can do to save your home or make an informed decision on what to do! If you own a home in Georgia, you don’t have time to waste.

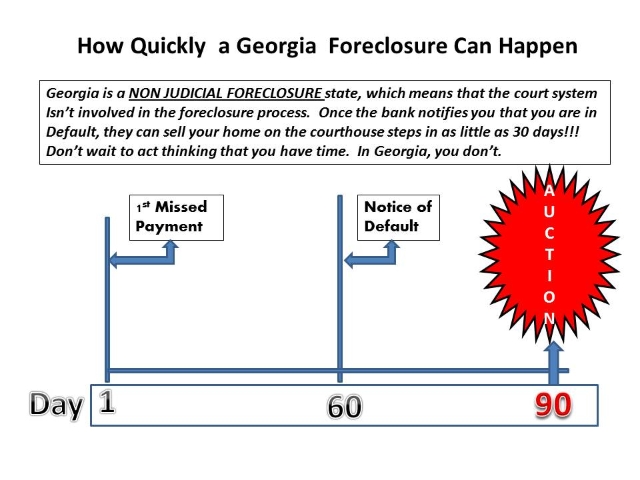

In Georgia, Your home can go to auction in as little as 90 days! Court action is not required for the bank to sell your home on the courthouse steps.

|

Don’t delay in finding out what you can do to

There are many families in a financial crisis so know that YOU ARE NOT ALONE! You are like many other homeowners who can’t believe they find themselves in this situation. After all, you have always paid your bills on time, always been proud of your credit worthiness, and just cannot fathom being unable to pay the mortgage on your home. The emotions range from disbelief to paralysis. Hoping it will go away…hoping that the bank will provide a solution… Hoping your financial situation will improve before it is too late.

It is human nature is to avoid dealing with any troubles. But, there is a way to break free. Look at the steps below and see what will happen if you continue to do nothing.

|

Regardless of where you are in this DENIAL process, learn NOW what you can do to protect your options and your rights. The sooner you act the sooner you can:

· Relieve the uncertainty

· Help your family

· Get a good night’s sleep

· Stop the harassing phone call

· Lift the weight off your shoulders

· Keep your children in their school

Remember, you cannot fix something you don’t acknowledge.

O.K., so if you are ready to act, what do you do first?

GET EDUCATED ON YOUR OPTIONS… NOW! CLICK HERE

You can do your own research on the internet –there are a lot of sites that can provide information on what options you may have to “fix” the problem…Information, write ups, Ebooks, etc. all may provide good information. The biggest challenge with all this data is the overwhelming amount of it, and the generic “one size fits all”. EACH DISTRESSED MORTGAGE SITUATION IS DIFFERENT.

And…Be prepared for lots of advice from friends, family, professionals. Warning! There are many horror stories, exaggerations and incorrect information. Click here to learn what some of the myths and misconceptions and what to watch out for.

Get some help from an expert. Find someone who specializes in working with people who are having mortgage troubles. Believe it or not, realtors are one of your best sources for information on your home and your options. BUT, make sure they work extensively with distressed homeowners.

If you want to set up a confidential no obligation phone call to find out what you can do now to help yourself. Please act before it is too late.

Recognize that foreclosure is absolutely the last and worst option you can choose. In Georgia, foreclosure doesn’t absolve you of your financial obligation for your mortgage. And, if you have a second mortgage, walking from your home doesn’t “wipe out” your second mortgage. It is up to the lender as to what actions they will take against you! There could be significant differences in the long term financial consequences of a foreclosure versus other options you can take. So before you act, click here to see some of the differences between foreclosure versus a short sale.

If you decide to move forward and work something out with your lender on your own, be prepared for a long, frustrating process. Click here to see a basic process/TIMELINE for a workout with your lender:

And…A couple of expert tips:

1. You will be required to provide a long list of documents .click here for a sample of some of the documents and please note: The lender’s request for documentation isn’t up for discussion or argument…either supply them everything they request of you will be denied your workout . Provide them in the exact format they require or you will be denied. If the lender requests the same information on multiple forms, fill them all out, or you will be denied! Click here for sample of what all lenders will ask for. HINT: USE WHATEVER FORMS THE LENDER REQUIRES!

2. These processes are complex and lengthy. Regardless of the lender, the process steps will be similar. So that you know what to expect, click here for an example of what the process looks like. Please remember, your most critical requirements to get all the documents filled out, dated, signed, and submitted. Until you do that, the process will not move forward. And time is not on your side

If, after you read this, you want help, please call or email me. I promise your situation and information will be kept confidential, and there is no obligation…just free advice and someone who can help you on your way.